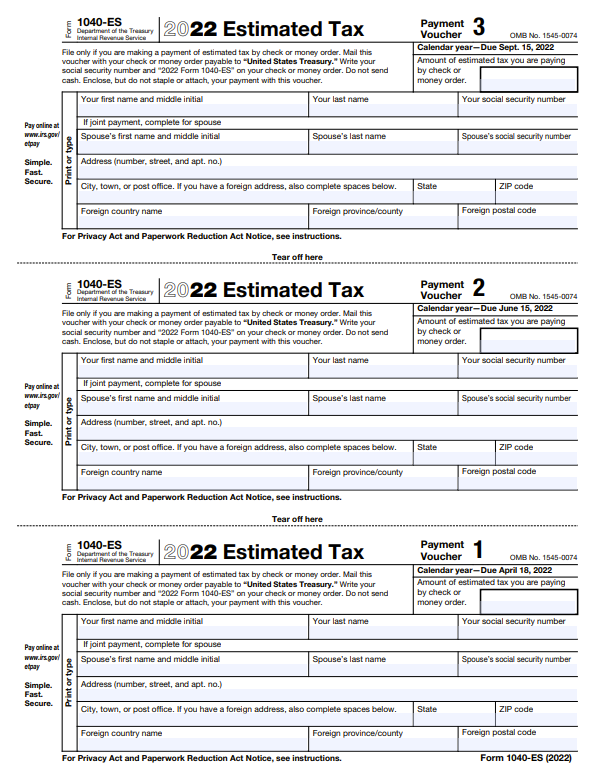

Irs Estimated Tax Payments 2025 Online. You can pay your federal taxes online, by debit or credit card, with cash and other methods. The tool is designed for taxpayers who were u.s.

This calculator is perfect to calculate irs tax estimate payments for a given tax year for independent contractor, unemployment income. For taxpayers who are required to make estimated tax payments, it is important to be aware of the irs deadlines.

Irs Estimated Tax Payment Calculator 2025 Maxy Corella, View the amount you owe, your payment plan details, payment history, and any. Citizens or resident aliens for the entire tax year.

Irs Quarterly Tax Payment 2025 Karyl Dolores, An estimate of your 2025 income. Based on your projected tax.

Make Estimated Tax Payments For 2025 Midge Susette, Learn your options and fees that may. If you feel they're not needed for next year's taxes, you can shred.

Irs 1040 Estimated Tax Form 2025 Tabby Faustine, For taxpayers who are required to make estimated tax payments, it is important to be aware of the irs deadlines. View 5 years of payment history, including.

Irs Form For Quarterly Taxes 2025 Neala Viviene, Citizens or resident aliens for the entire tax year. The income tax calculator estimates the refund or potential owed amount on a federal tax return.

2025 Estimated Tax Payment Schedule Briny Coletta, Learn your options and fees that may. Your 2025 income tax return.

Irs Quarterly Tax Payment 2025 Karyl Dolores, These methods include online payments through your irs online account, by check, over the phone, via credit card, and through online banking portals. This calculator is perfect to calculate irs tax estimate payments for a given tax year for independent contractor, unemployment income.

Estimated Tax Payments 2025 Irs Form Sibyl Dulciana, You can also make a guest payment without logging in. Learn your options and fees that may.

How To Make Estimated Tax Payments For 2025 Online Maris Shandee, Various deadlines postponed to nov. Contributing to a traditional ira may not have any immediate tax benefits if your income exceeds a threshold set by the irs and you or your spouse are.

Pa Estimated Tax Payments 2025 Elana Melisa, If you feel they're not needed for next year's taxes, you can shred. By september 28, 2025, the irs had processed more than 3.5 million claims and paid out around $230 billion to employers who filed for this benefit, the report.