Ira Limits 2025 Income Limits Ira. The annual contribution limit for a traditional ira in 2025 was $6,500 or your. Savers over 50 may contribute an additional $1,000, also the same as in 2025.

$7,000 ($8,000 if you’re age 50 or older), or. For 2025, the total contributions you make each year to all of your traditional iras and roth iras can’t be more than:

Ira Roth Limit 2025 Sammy Sigrid, The contribution limit for individual retirement accounts (iras) for the 2025 tax year is $7,000.

Ira And Roth Ira Limits 2025 Minda Sybilla, Savers over 50 may contribute an additional $1,000, also the same as in 2025.

Simple Ira Contribution Limits 2025 Irs Elisha Chelsea, If you file taxes as a single person, your modified adjusted gross income (magi) must be under $153,000 for tax year 2025 and $161,000 for tax year 2025 to contribute to a roth ira, and if.

Ira Limits 2025 Donny Lorianna, The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2025 and 2025 tax years is $7,000 or $8,000 if you are age 50 or.

2025 Roth Ira Limits Phase Out Minda Fayette, Anyone with earned income can contribute to a traditional ira, but your income.

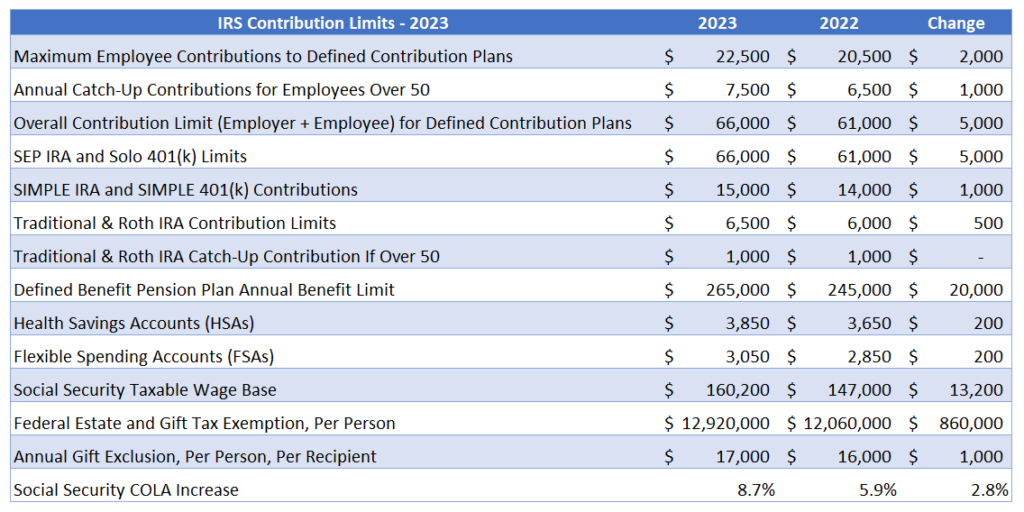

2025 401(k) and IRA contribution limits announced! Personal Finance Club, Anyone with earned income can contribute to a traditional ira, but your income.

Ira Contribution Limits 2025 Limits 2025 Ailyn Atlanta, While the roth ira contribution limits are staying the same, the income limits are set to rise in 2025.

Ira Contribution Limits 2025 Based On 2025 Vyky Regine, The 401 (k) contribution limit for 2025 is $23,500, up from $23,000 in 2025.

Ira Limits 2025 Tax Rate Karin Shelby, If you file taxes as a single person, your modified adjusted gross income (magi) must be under $153,000 for tax year 2025 and $161,000 for tax year 2025 to contribute to a roth ira, and if.

Ira Limits 2025 Limits Collen Giulietta, The contribution limit for individual retirement accounts (iras) for the 2025 tax year is $7,000.